Bitcoin Plan - April 21, 2021

Bitcoin Collateralized Loans, Legislation Tracker and Bitcoin Twitter

Dear Bitcoiner,

More and more Bitcoiners are considering how bitcoin collateralized loans can help them maintain cash flow, avoid taxes, and continue to hold bitcoin as their most pristine asset. However, there seems, at least to me, that there very little information out there about how bitcoin collateralized loans actually work. In this week’s newsletter, we are going to do a deep dive into understand the advantages and disadvantages of leveraging your bitcoin within a collateralized loan.

In this article, I will only be reviewing and analyzing Unchained Capital’s loan offerings. Naturally, I will be comparing Unchained Capital’s service against similar services. I am not sponsored, paid or otherwise compensated by Unchained Capital nor do I have any affiliation with their service. I have set up an Unchained Capital account for the purpose of preparing this article.

If you are considering getting a collateralized bitcoin loan, you will obviously have to go through the process of setting up your account. Assuming that you have already set up your account, to begin the collateralized loan process you have to send your bitcoin to Unchained Capital.

Storage

It is worth noting that when you seek to collateralize your bitcoin with Unchained Capital, your bitcoin is stored on cold wallet hardware devices which have been geographically distributed to mitigate honeypotting. Moreover, Unchained Capital has represented that these distributed devices are also spread between authorized personnel within the company. It is my understanding that Unchained offers two different options for securely storing your bitcoin on their service:

“Multi-Institution, Multisignature Address” – A multisig setup is created and the keys are distributed between the following “trusted” individuals:

Third party escrow agent

Unchained Capital employee

Your own approved hardware device

Any transaction would require 2-of-3 of the above-mentioned individuals to sign a transaction. This mechanism is an essential part of the process for Unchained. This means that you can not just take your bitcoin back.

“Single-Institution Custody” – Some customers apparently permit Unchained to hold all three private keys. These three keys would be geographically distributed and spread between a variety of unchain staff members. It should be obvious that this offers the lowest level of security over your bitcoin since you would not retain any private key.

Credit Checks

As far as I have been able to determine, Unchained is not using credit checks for loan determinations. However, it does appear that the Unchained has reserved the right to perform “soft credit pulls” for the purpose of evaluating borrowers.

To be clear, hard credit inquiries often will impact an individual’s credit score. However, conventional wisdom suggests that soft credit inquiries or pulls will not affect credit score or worthiness. The major distinction between a hard and soft credit inquiry is that a soft credit inquiry is not related to an application for new credit from a lender.

How the Loan Works

Unchained uses a basic formula to determine how much money you can borrow against your bitcoin. This formula is often called Loan-to-Value (LTV) ratio. Unchained lends at a LTV of forty (40) percent. This translates to permitting you to borrow one (1) US Dollar for every two and a half (2.5) dollars’ worth of collateral.

Moreover, Unchained calculates the LTV as follows:

Where Loan Principal is the amount of money you wish to borrow, which has been borrowed, or the amount of the loan which remains after some portion of the loan balance has been repaid.

Where Current Value of the Collateral is the amount of bitcoin sent to unchained multiplied by the current market price of bitcoin.

LTV = Loan Principal / Current Value of the Collateral

Each loan from Unchained is structured as a term loan. This means that you are only required to make interest payment on the loan amount for the duration of the term. However, upon the expiration of the term, you will be required to make a final lump sum payment to satisfy the loan obligation. Interest only payments in term loans are often referred to as balloon loans.

After you have determined how much you wish to borrow from Unchained, sent bitcoin, and finalized the terms of the loan, the loan amount is wired to your bank account. Wire transfers are only processed on working business days. No wires will be sent on weekends or on federally recognized holidays.

Loan Minimums, Terms, and Limitations

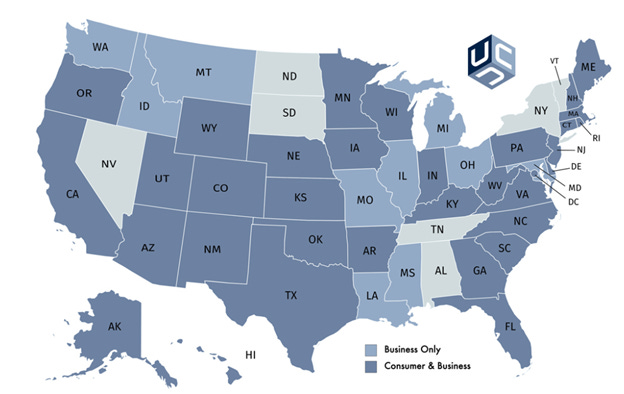

Unchained will not process a loan for a sum less than ten thousand (10,000) dollars, currently. Additionally, the loan applicant must resident in a state in which Unchained is permitted by law to make such loans. This map has been pulled directly from Unchained’s website showing where personal and business loans are available.

It is worth noting that I believe that certain states have varying or at least differing loan size minimums, interest rate requirement and other regulator limitations.

International loans are restricted, and I would recommend emailing hello@unchained-capital.com for questions related to your particular jurisdiction. I do understand that international loans have a loan minimum of One Hundred Thousand (100,000) US Dollars.

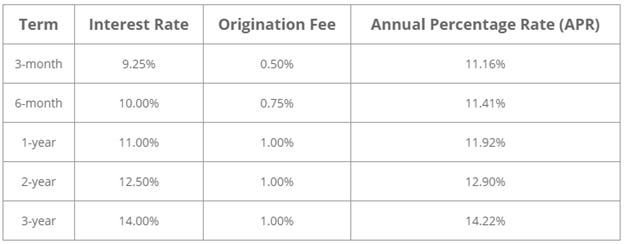

Loan terms vary quite drastically. Unchained offers a minimum term of 3 months and a maximum of 36 months. Naturally, the interest rates vary substantially when comparing loan terms. Here are the advertised Unchained interest rates and fees.

While the origination fee varies from 0.50 to 1.00 percent, it is important to remember that this fee is typically paid to compensate a lender for processing a loan. Nothing about this rate appears excessive, in my opinion. If you are unfamiliar with the idea of an origination fee, it is a percentage (as defined above) of the amount loaned not of the collateral pledged.

Margin Calls and Liquidation

Unchained has a well-defined margin call process. This process is broken down into three stages. Each of these three stages looks at something called the “Collateral-to-Principal” (CTP) ratio. CTP is the inverse of LTV which was defined above. Here is how Unchained defined CTP:

Where Current Collateral Price is the current price of bitcoin;

Where Current Collateral is the number of bitcoin pledged as collateral; and

Where Current Principal is defined as amount owed on the loan;

Then Collateral-to-Principal is defined as (Current Collateral Price x Current Collateral) / Current Principal.

CTP, for the purpose of margin calls and over-collateralization calculations, is represented by a percentage.

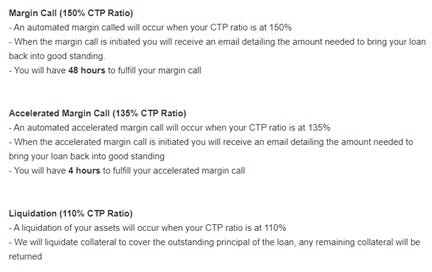

The three stages of the margin call process as defined as follows on Unchained’s website.

At the time the loan is created, the CTP rate should be 250%. However, in the event that the price of bitcoin decreases and you receive a margin call, you have several mechanisms to resolve the margin call.

Deposit more collateral;

Pay down the loan with fiat;

Authorize the liquidation; or

Wait for the price to increase.

According to Unchained, to clear the margin call, the borrower is required to bring the loan’s CTP ratio above One Hundred and Sixty-Five (165) percent after being margin called.

Please be aware that the above-mentioned four options are only available where CTP is above One Hundred and Ten (110) percent. At a CTP of One Hundred and Ten (110) percent, your collateral will be instantly liquidated.

If you are not aware, consenting to liquidation of collateral or forced liquidation permits Unchained to sell your bitcoin at their OTC desk. The funds received from the sale of the bitcoin will be applied to your outstanding loan balance in order to clear the margin call.

If you were not aware, Unchained uses CME CF Bitcoin Real-Time Index to determine the price of bitcoin for the purpose of loan processing. However, I have been unable to determine or discover how exactly Unchained goes about liquidating bitcoin via their OTC desk or any related procedures.

It is worth mentioning that margin calls appear to be sent to borrowers via email with a specific date and time deadline in order to clear the margin call. Depending on the CTP for your loan, the time to respond may be as short as four (4) hours. The Unchained website does state the following, “If a margin call is not satisfied by this time the loan will be considered in default and the collateral will be liquidated to return the loan a satisfactory CTP ratio.”

Over-collateralized Loans

In the event that the price of bitcoin increases to the extent that the CTP is greater than two hundred and fifty (250) percent, borrowers may request a partial return of collateral. While the Unchained website states that this number is three hundred (300) percent on certain pages and two hundred and fifty (250) percent on others, I would recommend reaching out to their support team should you find yourself in this position and find utility in requesting the return of some of your bitcoin.

You should expect that requests for the return of collateral will be processed once a month and it is likely a good idea to have a slightly over-collateralized loan to avoid being margin called.

Custody Risk

In closing, I would be remiss if I did not address the obvious concern that ever Bitcoiner should have when considering a service like Unchained. The nature of bitcoin is that it is our most pristine and valuable asset. Moreover, bitcoin is a “bearer instrument” and that requires consideration. Whomever holds the keys, controls the coins. While there have been numerous exchange hacks over the years, I have a certain level of respect for how Unchained has created and shared their code as open source for the purposes of promoting transparency to the community.

While Unchained specifically states that they will not and do not rehypothecate bitcoin, even when they are the sole custodian of that coin, there is significant downside risk of liquidation in the event of a significant bitcoin price drop. Moreover, Unchained’s multisig puts two (2) thirds of your keys in their possession.

It has been my experience that most Bitcoiners considering or utilizing bitcoin collateralized loans are doing so because they are illiquid in US dollars terms. These loans act as a mechanism for Bitcoiners to access US dollars without selling their most valuable asset. However, this value contains a downside risk in the event of a significant price drop. Should bitcoin experience a substantial price drop and you have secured a bitcoin collateralized loan, you may be margin called. Moreover, this margin call would require you to sell bitcoin or re-collateralize the loan.

Overall, Unchained’s service appears sound and well thought out. Their two-of-three multi-sign solution does provide some level of mental security for me, as a Bitcoiner, to consider using their service. While I wish there were more transparency as to how their liquidation procedures work as well as better notification mechanisms for margin calls, I suspect that I might consider using this service in the future.

I hope you have found value in this information and should I be able to help in any way, please do not hesitate to let me know.

If you feel overwhelmed by the information discussed above and you would like a neutral party to help facilitate the conversation and provide guidance regarding bitcoin collateralized loans, consider scheduling an in-person or virtual meeting with me directly.

Bitcoin Articles & Information

Solar Battery Bitcoin - Github, Ark Invest

Saylor v. Giustra Debate - Youtube

Bitcoin and the Changing Definition of CPI - Bitcoin Magazine, Mitch Klee

Cashapp Raised Minimum Withdrawal to 100,000 Sats - Casey

German stock exchanges will delist Coinbase shares, citing 'missing reference data' - by Turner Wright

Proposed Legislation Tracker

For The 99.5% Act

On March 25, 2021, Senators Bernie Sanders and Sheldon Whitehouse introduced the “For the 99.5 Percent Act” into the Senate. The proposed legislation would make massive changes to estate, gift, and generation-skipping transfer exemptions. If passed the Act would:

Reduce the current exemption amount ($11.7 million per individual for 2021) to $3.5 million per individual, adjusted for inflation. The exemption for married couples would be $7 million.

Reduce the gift tax exemption to $1 million per individual, not adjusted for inflation.

Make the estate and gift tax rate progressive, ranging from 45 percent of the value of estates between $3.5 million and $10 million to 65 percent of the values of estates in excess of $1 billion.

Eliminate valuation discounts for nonbusiness assets.

Treat grantor trusts created or funded by a grantor as owned by the grantor for both income and estate tax purposes.

Require dynasty trusts to terminate after fifty years.

Reduce the annual gift exemption from $15,000 per donee per year to $10,000 and impose an annual cumulative limitation per donor as well.

Increase the maximum estate tax exclusion for conservation easements from $500,000 to $2 million.

Ultra-Millionaire Tax Act of 2021

On March 1, 2021, Democrat Senator Elizabeth Warren introduced the Ultra-Millionaire Tax Act into the Senate. While commentators believe that this Act is unlikely to pass, as it does not have President Biden’s support, it is worth keeping an eye on. The proposed changes include the following:

Impose a tax of 2 percent on the net value of all taxable assets of taxpayers in excess of $50 million up to $1 billion.

Taxpayers with taxable assets of $1 billion or more would have to pay an additional 1 percent, meaning that their total annual tax would be 3 percent.

Certain economists have estimates that should this Act pass, that over 100,000 taxpayers will be subject to the ultra-millionaire tax.

Bitcoin Twitter

Hope you found value in this week’s issue. If you have any friends that are looking to find out more about Bitcoin or Bitcoin Planning have them sign up for this newsletter here:

Thanks for reading! @BitcoinPlanner