Bitcoin Plan - April 29, 2021

Bitcoin Health Insurance, Bitcoin Loan Calculator, and Blockfi Rate Change

Dear Bitcoiner:

There has been a lot of activity as usual in the bitcoin space. But this week’s newsletter is going to be somewhat different. Instead of picking a big picture topic to analyze like Bitcoin IRAs, SIM Swapping, or Bitcoin Collateralized Loans, I want to share a bit of what we are working on behind the scenes.

Bitcoin Health Insurance

At present, I am working with a team of lawyers to analyze the benefits and mechanisms of creating Bitcoin Health Care Savings Accounts (HSA). If you aren’t familiar with the concept, a traditional HSA is a type of savings account that allows you to set aside pre-tax money to pay for qualified medical expenses. These untaxed dollars can be used by you and your family for to pay for deductibles, copayments, coinsurance, and some other expenses. These funds generally cannot be used to pay for health insurance premiums. If you want to learn more about traditional HSA’s consider read IRS Publication 969 (2020).

At the risk of overexplaining, a HSA is like a personal savings account. It generally permits you to pay bills, save for future medical expenses, and also invest in certain stocks, bonds, and mutual funds. To have an HSA you need to enroll into a qualified High-Deductible Health Plan (HDHP).

HSA’s have three key tax advantages:

You don't pay federal income tax on contributions.

When you invest a portion of your balance, you aren't taxed on the earnings as it grows. However, there may be situations that trigger unrelated income taxes.

Paying for qualified medical expenses is tax-free, whether you make the withdrawals now or in the future.

Now assuming that bitcoin can be held as an approved asset in an HSA, imagine being able to funds your HSA with bitcoin. Your contributions, while limited to $3,550 for individuals and $7,100 for families per year, in bitcoin. Here are the benefits we have analyzed so far:

Fund your HSA with pre-tax bitcoin, if possible.

Fund your HSA with bitcoin, tax free;

Watch your bitcoin contributions grow compared to US dollars; and

Pay for your medical expenses tax-free.

This seems to be a no-brainer. However, there is a lot of work to be done to explore the regulatory environment surrounding this concept as well as work to be done to ensure that this is a sound solution for health conscious Bitcoiners like you and I.

It is my hope to report back in the next sixty days with details on the regulatory environment and a complete analysis of bitcoin HSA’s.

Unchained Capital Calculator

Last week we broke down the bitcoin collateralized loan service offered by Unchained Capital. This week I want to share a small website we designed to help Bitcoiners understand and visualize exactly what is being offered from Unchained Capital. We are proud of our humble but powerful tool called, “Negative Bitcoin.”

While it is impossible for wallets to have a negative balance, I wanted to design a tool that make Unchained’s offering a little more easy to understand. When you visit the site, simply enter the amount you wish to borrow (principal) and the term of the loan, and the calculator will output:

How much bitcoin collateral you will need;

Your estimated monthly interest payment;

The total amount of interest owed;

Origination fees; and

Margin call risks.

I hope you find this tool helpful when evaluating whether a collateralized loan is right for you.

Blockfi Rates: They Be A Changin’

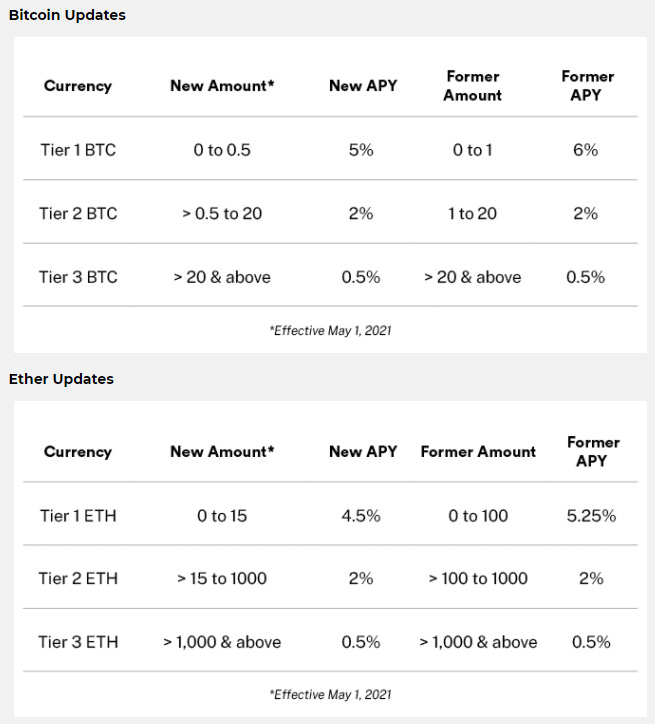

Blockfi announced their updated rates for BTC and a variety of other shitcoins that are willing to accept that goes into effective on May 1, 2021. This rate update was published on April 26, 2021 and can be found on their blog.

The announcement in part says, “[d]ue to shifting market conditions, BlockFi will be adjusting the APY for several supported cryptocurrencies starting May 1, 2021. These changes will affect Bitcoin (BTC), Ether (ETH), Chainlink (LINK), Litecoin (LTC), and PAX Gold (PAXG).” Blockfi Blog.

Stay tuned to see how the Blockfi advocates react to this news.

Bitcoin Twitter

Hope you found value in this week’s issue. If you have any friends that are looking to find out more about Bitcoin or Bitcoin Planning have them sign up for this newsletter here:

Thanks for reading! @BitcoinPlanner